Digital marketing for financial companies is essential to attract new clients and compete with digital-savvy start ups whose slick online customer experience appeals to younger people.

The traditional financial sector lags behind fast paced changes in the digital world. Many companies miss opportunities for client acquisition and retention. When it comes to digital marketing for financial companies, there are fundamental to be followed

1. Appreciate The Need For Digital Marketing

The financial industry is heavily regulated with rigid organizational structures making it slow to adapt to digital advances. The 2017 Digital Trends in Financial Services and Insurance report* found that only 9% of financial services and insurance organisations claim to be digital-first.

New financial brands put digital marketing at the top of their agenda. Established financial companies must now take digital marketing seriously. They must:

- understand what digital marketing is and how it helps businesses meet their objectives

- realise that digital marketing specialists are needed to get best returns on investment

- assign a useful budget to digital marketing activities

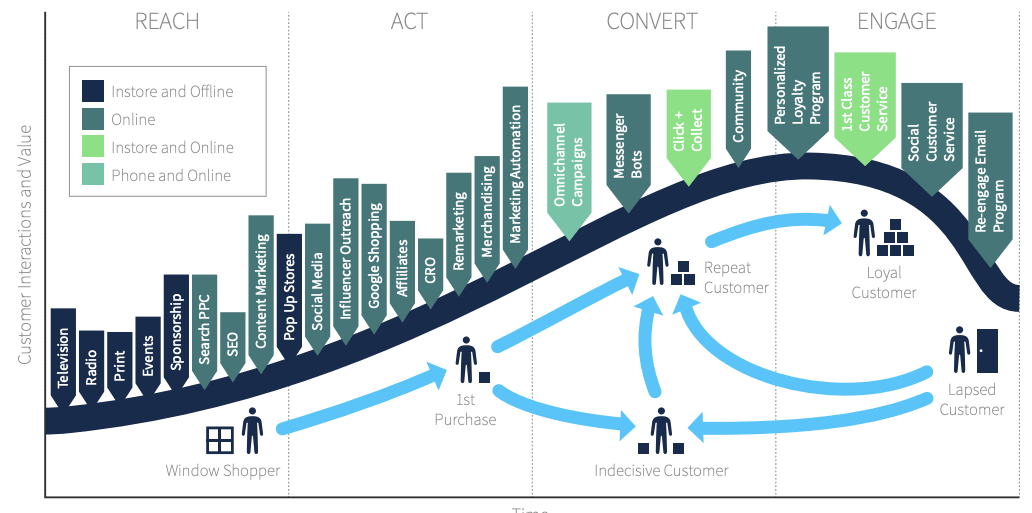

2. Have A Digital Marketing Strategy

Once a financial organization decides to up its game in the world of digital marketing, it needs well-defined digital marketing strategies. There’s no point in having a Twitter account or posting videos on YouTube and hoping for the best. A strategy must address these areas:

2.1 Website

- Is the website professionally designed to current standards?

- Are the company’s services clearly described on the homepage?

- Is the website fast to load and easy to navigate on both desktop and mobile?

- Is the website optimised for the search engines using the best on-page SEO techniques?

2.2 Content Marketing

- Is the company creating regular content in the form of videos, blogs and/or podcasts?

- Is content being shared on appropriate channels?

- Is the company investigating ways to get its content shared via guest blogging or video interview opportunities?

2.3 Social Media

- Has the company built a strong social media presence on relevant channels?

- Has the company allocated sufficient time to social media activities in order to increase engagement and reach out to potential clients?

2.4 Paid Advertising

- Is the company investing in paid digital advertising, for example Facebook ads or Google Adwords?

- Has the company designed a remarketing strategy to reach out to website visitors who have never purchased?

2.5 Customer Retention

- Does the company send clients eNewsletters and personalised emails as part of a customer retention strategy?

Using digital marketing specialists to define a marketing strategy, the business is clear about what needs to be done, and allocates the budget required to implement it.

3. Put The Customer Experience First

It’s no longer just about the products you sell, client experience is now just as important. Customers have higher expectations than ever before. Potential new clients expect:

- a fast-loading, professional website

- to find what they want on the site, as quickly as possible

- a rapid response to questions, whether submitted via email, website or social media

Existing clients interact with a financial website to check relevant information, for example checking performance of their portfolio or the stock markets. They do not want delays or need to speak to someone. They’ll expect this on their smartphones as well as on their desktops. A financial company website must have functionality that allows customers to achieve what they want, when they want.

Customer service must be exceptional. If a customer raises an issue, it must be promptly and efficiently resolved. Customers need reassurance that they are using the best financial services company for their needs. Otherwise they will switch provider without a second thought.

4. Monitor Customer Reviews

Financial services companies must monitor customer reviews online at Google Reviews, Trust Pilot, Glassdoor and others. If there’s a negative review, the company must take immediate action as potential clients are strongly influenced by online reviews:

- Decide if the comment is justified and define processes to ensure the issue doesn’t arise again.

- Respond where possible in a non-confrontational way. This shows that the business cares enough to reach out to their clients and can help limit damage to the company reputation.

5. Fully Analyse Data

When undertaking digital marketing for financial companies, it’s essential to understand its effectiveness. Gather data regularly about:

- website ranking – Is it improving and ranking for the right keywords?

- website visitor numbers – Are they increasing? Do the demographics match your target market?

- website visitor behaviour – Are bounce rates decreasing? Are people spending more time on the site? Are people completing goals?

- social media statistics – Are engagement rates improving? Are you attracting more fans and followers?

- content marketing – Are you getting plenty of page views? Are you getting comments and shares?

- Google Adwords – Are you getting good click-through rates and plenty of conversions?

- email marketing – Are your email open rates above the industry norm?

- competitors – How do you compare to your competitors?

This data can then be used to inform future decisions and define strategy adjustments.

Digital marketing for financial companies will produce rewards when carried out to a clearly defined strategy created by specialists. Digital marketing is an essential requirement in today’s tech-savvy world. So if you’re a financial organization, embrace digital marketing and ensure you implement your digital marketing strategy for maximum effect as shown above.

Want to learn more?

Visit our Financial Marketing Page

*http://the.report/assets/Digital%20Intel%20Finance%20Econ.pdf