Last updated on

In the realm of search marketing, the dynamics of ad auctions wield significant influence over ad positioning and expenses.

Following the Department of Justice (DOJ) trial involving Google, certain aspects of the ad auction process have garnered increased attention within the advertising sphere.

Given the trial’s focus, nuances of the auction system have been depicted as potentially driving up advertising expenses. However, while elevated costs per click (CPCs) understandably raise concerns, it’s worth contemplating whether they might inadvertently indicate a desirable outcome for advertisers.

In my opinion, CPC shouldn’t be a primary concern.

Instead, emphasis should be placed on metrics such as cost per action (CPA), return on ad spend (ROAS), return on investment (ROI), or other metrics that directly correlate with business outcomes, rather than solely focusing on CPC.

If you agree with this perspective, you’ll find the remainder of my post aligns with your viewpoint. However, if you’re open to reconsidering the notion that a higher CPC isn’t always negative, then continue reading to discover how to articulate this to a boss or client who consistently expresses concerns about high CPCs.

We’ll delve into critical aspects of ad auctions, including ad rank thresholds and reserve prices, out-of-order promotions, Randomized Generalized Second-Price (RGSP) mechanisms, and pCTR normalizers. Understanding these components will shed light on how they function together to cultivate a more efficient advertising ecosystem.

But before we delve into that, let’s establish some foundational knowledge about the ad auction process.

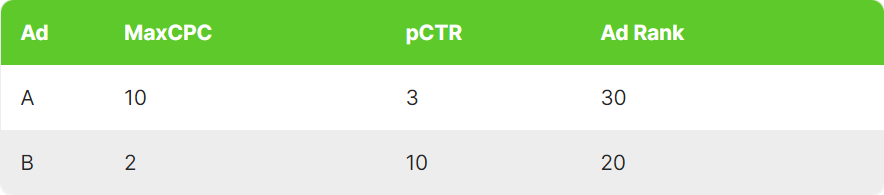

Ad Rank serves as a cornerstone of ad auctions, harmonizing bid values with ad quality to ascertain the positioning of ads on the search results page. Its foundation lies in a simple yet powerful formula:

Ad Rank = Max CPC × Predicted CTR

This formula meticulously weighs both the bid amount and the quality of the ad, ensuring that ad placement is determined by a blend of financial investment and anticipated user engagement.

Predicted CTR (pCTR) stands as a pivotal metric in this equation, offering an estimation of the likelihood that an ad will be clicked when displayed for a specific search query. This metric holds immense significance as it mirrors the ad’s relevance and anticipated performance, thus influencing its positioning within the auction.

In the realm of ad auctions, the actual cost-per-click (CPC) that advertisers incur is intricately linked to the projected click-through rate (pCTR) of their ads.

In essence, ads boasting higher pCTR stand poised to secure superior ad placements at a reduced actual CPC, in contrast to ads with lower pCTR.

This dynamic incentivizes advertisers to craft ads that are not only highly relevant but also engaging, aligning closely with user intent. Enhancing pCTR not only promotes more efficient spending but also facilitates more favorable ad placements within the auction ecosystem.

You’ve got it spot on, and you’re not losing your mind. As we delve into the intricacies of ad auctions and their impact on costs, it’s crucial for advertisers to grasp that Google’s ad auction operates as a cost-per-thousand-impressions (CPM) auction, not a cost-per-click (CPC) auction.

This distinction might seem evident. After all, the projected click-through rate (pCTR) plays a pivotal role, and simply having the highest MaxCPC doesn’t guarantee victory.

Advertisers submit bids in the form of a maximum CPC (or establish target return on ad spend (tROAS) or target cost per action (tCPA), which are then translated into a MaxCPC during each auction). When combined with the predicted click-through rate (pCTR), these bids yield an estimated cost per thousand impressions (eCPM).

The ad boasting the highest eCPM emerges victorious in the auction. Given that the ad with the highest ad rank prevails, we can deduce that ad rank and eCPM are essentially interchangeable.

Furthermore, any publisher will affirm that the most effective way to monetize a finite number of website visits is by maximizing the CPM. Thus, it follows logically that Google aims to sell ads to advertisers offering the highest CPMs. I elaborate on this concept in a video explanation.

pCTR stands as a dynamic metric pivotal in shaping ad placement and costs. It’s tailor-made for each auction, factoring in the unique context of the search query.

Advertisers boasting high pCTR enjoy the perks of lower CPCs and prime ad positions, courtesy of a system that values relevance and enhances user experience.

For advertisers, grasping and refining relevance is paramount. Ads of superior quality, resonating with users, are primed to achieve elevated pCTR, thus trimming overall costs while bolstering campaign efficacy.

This ever-evolving nature of pCTR ensures advertisers continually strive to enhance ad quality, fostering benefits for both users and advertisers alike.

Quality Score (QS) and projected click-through rate (pCTR) are both indispensable components for advertisers, yet they serve distinct purposes.

QS is a numeric value ranging from 1 to 10, serving as a measure of the quality and relevance of an ad. It considers various factors such as ad relevance, landing page experience, and historical performance. This metric acts as a crucial guidepost for advertisers, aiding them in crafting more pertinent ads.

Conversely, pCTR is a dynamic metric that gauges the likelihood of an ad garnering clicks for a specific search query. It fluctuates with each auction, offering a real-time estimate of the ad’s anticipated performance. While QS offers a broad evaluation of ad quality, pCTR hones in on predicting user engagement for individual auctions.

Now that we’ve laid down the groundwork of the ad auction process, let’s delve into the nuanced aspects that have surfaced during the trial.

The process of ad auction goes beyond simply ranking ads and displaying them based on their ranks. It involves various thresholds that dictate aspects like an ad’s eligibility for prime placement on the page and the minimum price for it to appear at all.

These thresholds differ depending on factors like ad quality, position, user signals, and the specific search topic. Google considers ads as informative responses and sets a quality standard that ads must meet to appear above organic results.

As a result, many searches feature fewer than four ads above the search results. Google’s internal data from 2020 reveals that less than 2% of all Google searches displayed four or more ads, regardless of their position on the page.

To grasp this concept, we introduce the idea of an ad’s long-term value (LTV), which measures the economic gain from displaying the ad minus the anticipated cost of displaying it.

The economic gain is determined by the ad’s rank, calculated as pCTR (predicted click-through rate) multiplied by Max CPC (maximum cost per click), representing the projected earnings Google expects from displaying the ad.

The cost of displaying the ad is an estimation of the potential negative impact on user experience, such as causing users to avoid future ads or develop ad blindness.

This predicted negative impact sets the threshold, or reserve price, for an ad. Only if its economic gain exceeds the anticipated cost can the ad be displayed. Therefore, if LTV > 0, the ad becomes eligible for display.

This implies that ads may need to bid higher than $0.01 (or the equivalent lowest currency in other markets) to appear, consequently driving up prices.

If all second-price auction prices were solely determined by the next competitor, many advertisers might fall below the LTV > 0 thresholds, despite having a maxCPC that could surpass the threshold.

Google respects the advertiser’s desire to display their ad by gathering the necessary CPC to counterbalance the anticipated negative value of displaying the ad.

Think of the threshold as an unseen participant in the ad auction, whose ad is linked to the position of the threshold. Exceeding this threshold increases the effective CPC an advertiser pays, yet it also allows the advertiser to have their ads displayed in situations where they might not have been otherwise, all while paying no more than their maximum bid.

For instance, if your ad is the only eligible contender in a scenario, you might need to pay the reserve price, which is influenced by the thresholds.

In a scenario lacking strong competition, even a very good ad with high quality and a high MaxCPC might struggle to meet the threshold. To ensure the advertiser’s objectives are met, Google adjusts their effective CPC to meet the threshold and enable their ad to be displayed (LTV > 0).

Now that we grasp reserve prices and thresholds, let’s delve into a specific example concerning the threshold for displaying ads at the top of the page.

When ads are promoted out of order, it means that an ad with a lower Ad Rank is permitted to be promoted above an ad with a higher Ad Rank.

Let’s delve into this further.

The thresholds involve a relevance component; for instance, Google might stipulate that an ad can only be promoted to the top of the page if it meets a certain level of relevance (such as pCTR).

Because Ad Rank comprises MaxCPC and pCTR, it’s conceivable that a lower-ranked ad (Ad B) could possess a superior pCTR but remain relegated to the bottom of the page behind a higher-ranked ad (Ad A) with a lower pCTR.

If the pCTR promotion threshold were set at 5%, and Ad Rank were strictly adhered to, neither of these ads could secure a spot at the top of the page, even though ad B exhibits high quality. It would be compelled to remain behind Ad A to honor Ad Rank.

In out-of-order promotion, ad B is permitted to leapfrog over ad A.

When advertiser A’s low-quality ad fails to meet the promotion threshold, while advertiser B does meet it, instead of pushing both advertisers to the bottom of the page, advertiser B is promoted out of order above advertiser A.

Now, advertiser B pays the CPC required to surpass the top-of-page threshold (reserve price), which is higher than if they were left at the bottom of the page. It can also exceed the amount needed to surpass the Ad Rank of Ad A.

Out-of-order ad promotion, which prioritizes ads based on factors beyond just the bid amount, offers advantages to advertisers. This method takes into account multiple thresholds, such as ad relevance, ensuring that high-quality ads stand a chance to be showcased in top positions even if their Ad Ranks aren’t the highest.

This can level the playing field for smaller advertisers with highly relevant ads, enabling them to compete effectively against larger competitors with larger budgets.

By prioritizing ads based on relevance and quality, advertisers are motivated to craft more engaging and valuable ads, which ultimately enhances user experiences and boosts conversion rates.

In a conventional second-price auction, the ad spot is awarded to the highest bidder, who pays the price of the second-highest bid.

However, it’s crucial to recognize that the second price is contingent on pCTR, a figure forecasted using machine learning. Since predictions aren’t always precise, it’s possible for multiple advertisers to be closely competing, with their only distinguishing factor being an ML-generated pCTR.

To prevent inaccurate predictions from becoming entrenched truths, ads can be randomly reordered. This introduces opportunities for experimentation, enabling the ML algorithm to assess its accuracy and refine future predictions.

RGSP (Randomized Grid Second Price) is a system designed to ensure proper normalization handling. Normalization data relies on ad variation; if ads remain static, there’s limited data for normalization. Observing an ad’s performance when it wins and loses is essential to discerning how much of its success stems from inherent quality versus external factors like placement.

RGSP injects an element of unpredictability into the auction process, motivating advertisers to bid their true value rather than strategically underbidding.

With ads being randomly reordered, diverging from the typical ad ranking mechanism, CPCs (Cost Per Click) may vary, potentially leading to increased prices for certain advertisers.

This mechanism aids in preventing ads with consistently high predicted relevance from monopolizing top positions, thereby promoting diversity among displayed ads. By nurturing a competitive atmosphere, RGSP mechanisms incentivize advertisers to prioritize ad quality and relevance, potentially resulting in improved performance and increased return on investment (ROI).

It also serves to prevent ads with inaccurately predicted high pCTRs from unfairly maintaining top positions and outperforming newer ads with inaccurately predicted low pCTRs.

Google’s normalization techniques ensure that the ranking of ads reflects their relevance, rather than being swayed by external factors like ad format or position.

By incorporating metrics such as projected click-through rate (pCTR) and adjusting for variables like ad format, the system establishes an equitable platform for all advertisers.

Ad ranking is partly determined by pCTR. However, we understand that the click-through rate is influenced by more than just the ad text itself. For instance, all other factors being equal, ads in higher positions tend to garner higher click-through rates compared to those in lower positions. Additionally, ads with more visible lines of text typically achieve higher click-through rates than those with fewer lines.

Project Momiji endeavors to standardize pCTRs, ensuring that advertisers are not unfairly disadvantaged due to differences in ad formats that might affect visibility and appeal.

When pCTR is normalized for ad formats and page position, certain advertisers with initially high pCTRs may experience a downward adjustment. This adjustment accounts for the fact that the high pCTR was partially influenced by the inherent advantages of a more attractive ad format or a superior page position.

To ensure fair competition among advertisers, this normalization process may result in some advertisers paying more than they would have without it.

For instance, consider an ad displayed in position 1 with a pCTR of 10%. If this same ad were shown in position 2, its pCTR might have been only 8%. Behind these numbers lies an underlying ad relevance pCTR, which can be approximated by eliminating all factors that artificially inflate the pCTR due to variables beyond the advertiser’s control, such as ad formats, page position, and the presence of additional ads.

Google can then determine the pricing of all ads based on their normalized pCTR. In the given example, if the pCTR for the auction is initially 10%, but after normalization for all relevant factors it’s reduced to 8%, the advertiser’s effective CPC will consequently be higher.

Normalization methods thwart unfair advantages arising from superior positions or ad treatments, guaranteeing that ad pricing mirrors genuine relevance. Such an approach serves advertisers by fostering equitable competition and incentivizing investments in premium advertisements that resonate with user intent.

Understanding the nuances of ad auction dynamics is essential for advertisers aiming to refine their campaigns and attain superior results.

Although higher CPCs may initially seem unfavorable, they often stem from mechanisms crafted to enhance ad quality, relevance, and user experience.

By prioritizing metrics like CPA, ROAS, and ROI, advertisers can gain a deeper understanding of the advantages of these dynamics.

Various elements within the ad auction, including ad rank thresholds, out-of-order promotions, and RGSP mechanisms, collaborate to establish a competitive yet equitable atmosphere.

This fosters a culture of continual enhancement among advertisers, ultimately benefiting both their enterprises and the audiences they target. By embracing these intricacies and striving for top-notch, pertinent ads, advertisers can navigate the ad auction landscape more adeptly and achieve heightened success in their digital marketing endeavors.

Original news from SearchEngineJournal